Why Use Crypto

By Zachary Carlin at

Why Use Crypto?

Its built-in mechanisms of trust and attribution make it appealing as a way to organize networks where people want to share information

You've probably heard of bitcoin and cryptocurrencies by now. You may still be asking yourself why care? If you don't inherently see the use of this, it's okay, you're privileged and probably have access to a quality financial institutions.

According to a recent study done by The World Bank close to one-third of adults – 1.7 billion – are still unbanked,

The Global Findex database is the world’s most comprehensive data set on how adults save, borrow, make payments, and manage risk. Launched with funding from the Bill & Melinda Gates Foundation, the database has been published every three years since 2011.

That's too much economic activity to be missing out on. Especially when simple internet access is all that is needed to create a crypto wallet and gain access to the new decentralized financial sector (DeFi).

People simply don't have a bank they can access and fewer people have a bank, currency, and government that they can trust to create a safe, fair, and inclusive financial system.

Even if you live in America and you're a minority you can benefit for using decentralized financial systems that crypto provides. It's a sad fact that banks can decide not to give you a loan just based off of your skin color. When they do they can still give you a higher interest rate :/

Isn't crypto volatile

This was true in the early days of crypto, now not so much with the acceptance of stable coins.

Stable coin - a coin thats value is pegged to another asset (example : 1 USD coin = 1 USD)

You can still invest in the American economy and the USD, just in a decentralized way. This also allows you to diversify your assets in anyway you choose too. Ultimately give you more financial freedom. If you want to you could hold your assets like the following (not advice)

| Token | Percentage |

|---|---|

| Bitcoin | 20% |

| Ethereum | 20% |

| DAI (USD coin) | 30% |

| AUD (Australian Dollar) | 10% |

| CHF (Swiss Franc) | 20% |

As you can see that helps spread your value over multiple markets, which reduce the chance of something like Hyperinflation that plagues countries in Latin America. Those countries know it. That's why in some you can only exchange $200 worth of that currency a month. There citizens want a stable place to keep their assets and their countries current financial institutions are not only failing to provide that but are also restricting their citizens to trade and do as they please with something they should own. Crypto offers a way to put the people in charge of their value.

Why not use gold?

It’s already universally accepted and has a finite supply.

Well gold is heavy and hard to move. If you wanted to send some gold to someone in Japan without trusting a 3rd party you can’t. The closest you can get to that is if you were to physically travel to Japan and hand that person the gold yourself. Even in that situation you used an immense amount of travel services aka 3rd parties and took the personal time and risk of carrying gold to someone.

Bitcoin is universally accepted, has a finite supply, is highly portable, secure and trustless. You put in that persons address which could be as simple as zacarlin.crypto and transfer the funds directly to them.

Think about that for a second...

Security

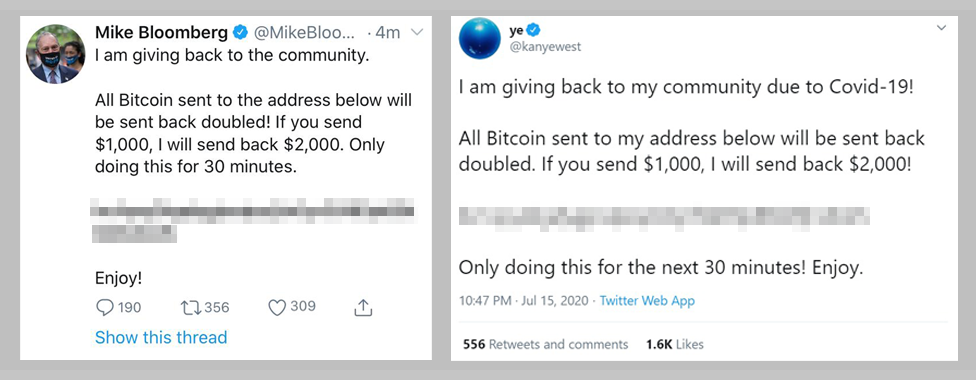

Bitcoin and cryptocurrencies in general are built with security in mind. Bitcoin has never been hacked. This is evident in the recent twitter hack that had multiple public figures, and companies posting tweets saying to send bitcoin to a wallet address. This resulted in about 10BTC or 100,000 USD being scammed from people foolish enough to fall for this.

Cryptocurrencies ultimately put you in charge of your funds, and security. What you do is your choice. Unfortunately this extra freedom requires the end user to be more conscious and aware.

DeFi

One extremely promising sphere of crypto that is currently seeing real world applications being built and used is the decentralized finance sector or DeFi. It’s no secret that banks don’t actually keep all of your money in their vaults. The government only requires them to hold a certain percentage of all of their users funds at any time. This allows them to make money off of yours by giving out loans or using it for investments. They then give you a tiny fraction of this revenue, my wells fargo account gives me .01% interest, take into account inflation and you literally lose buying power in this system. DeFI changes this...

Smart contracts built on cryptos like ethereum remove the middleman from systems like banks. You can now loan out the money you don’t use and reap the benefits from the interest instead of a 3rd party taking in my case a corrupt and unfair amount.

Seriously look at moving a portion of your saving into a high interest savings account. That’s not new financial wisdom, what I’m suggesting is to use these new financial tools 🧰 with existing wisdom to empower yourself to actually reap rewards from your money.

Some DeFi tools/protocols id suggest are

- Maker

- Uniswap

- Aave